Down 35% this year, Pinterest (NYSE: PINS) stock could see a further decline after disappointing news that saw US inflation come in above consensus at 8.2%. If so, could this drop be a buying opportunity?

Bursting the bubble

High inflation and rising interest rates have been the main culprits behind the decline of Pinterest stock. All three US indexes are in bear market territory as investors brace for a recession. Given the company’s position as a growth stock, its future cash flows are expected to be hampered as consumer spending decreases, hence the monumental drop in its stock price, from $86 to $21 over the last year.

Nonetheless, Pinterest has been equally responsible for the downfall of its own stock. Its failure to hold onto monthly active users (MAUs) and its slow rollout of new features caused investor sentiment to weaken over the past year. As a result, investment bankers and brokers alike have steadily reduced Pinterest’s price target.

Ready for a change

However, fortunes for the company began to change when new CEO Bill Ready entered the fray. With an abundance of e-commerce experience, he’s pioneered Google’s mobile pay system and was CEO at PayPal‘s Braintree and Venmo. His impressive CV positioned him as a strong candidate to lead Pinterest’s growth in the e-commerce space.

In addition to that, activist investor Elliott Management acquired a large position in the company. The fund is known for its ability to pressure companies into improving its margins and growth prospects. As such, investors and analysts took kindly to this news. Subsequently, this saw Pinterest stock lift itself from its all-time low of $17.19 to leap as high as $25.83, over the last three months.

Besides that, Pinterest has also seen an improvement in its business. The tech company has been able to continue growing its revenue, with average revenue per user (ARPU) also seeing healthy growth. The infamous decline of its MAUs also seem to be tapering off as management guided for a rebound in users going into H2. The introduction of its collage-making app, Shuffles, has sparked plenty of hype and could help its MAUs as well.

| Metrics | Q2 2022 | Q2 2021 | Change |

|---|---|---|---|

| Revenue | $666m | $613m | 9% |

| Non-GAAP earnings per share (EPS) | $0.11 | $0.25 | -56% |

| MAUs | 433m | 454m | -5% |

| ARPU | $1.54 | $1.32 | 17% |

That being said, Pinterest will have to show an improvement to its bottom line. After a disappointing decrease in non-GAAP earnings in Q2, investors will be hoping for a turnaround. A continued drop in EPS is definitely a cause for concern as it could mean further downside for its stock price.

Solid platform

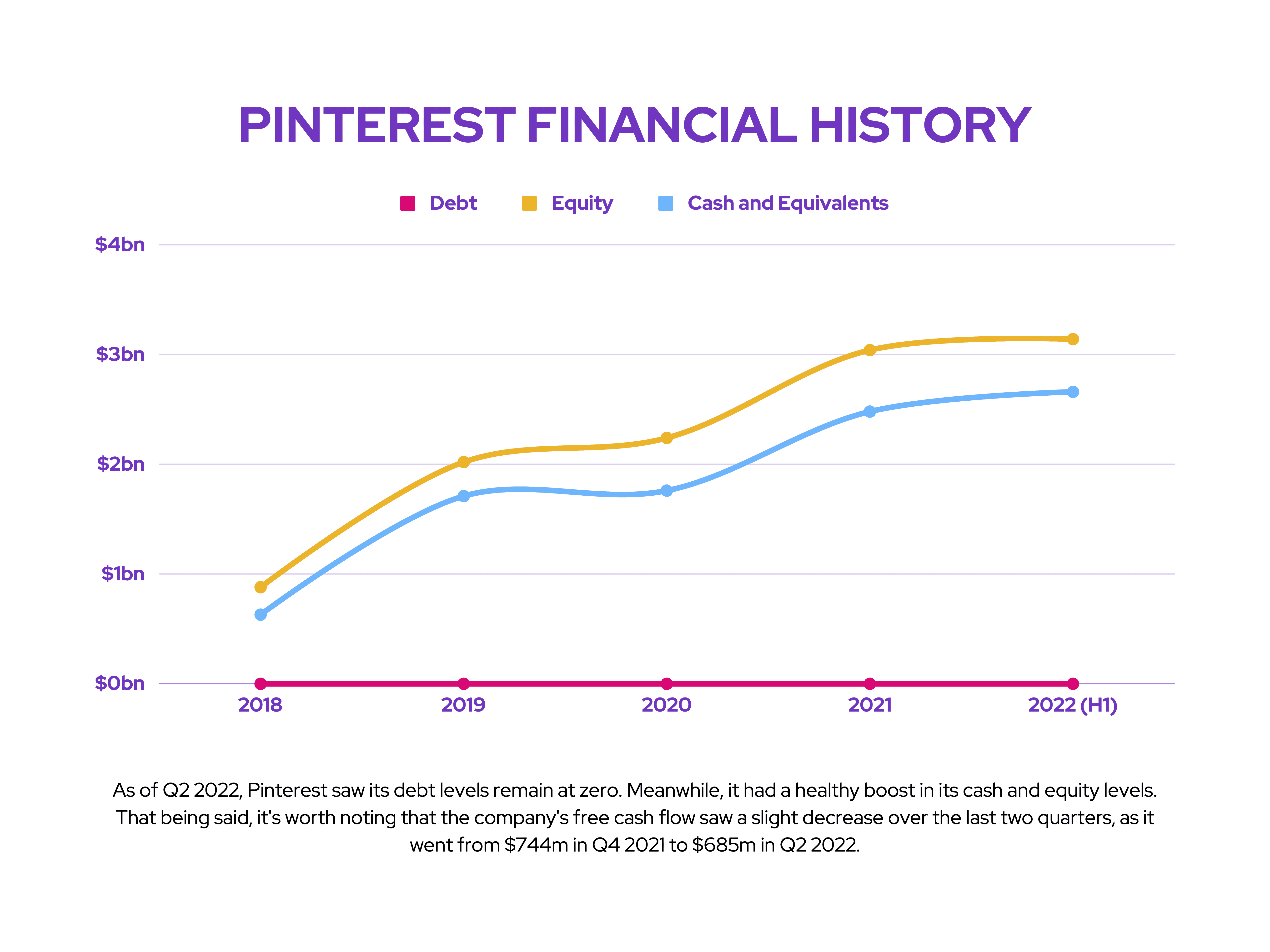

So, could this be an opportunity to increase my position in Pinterest stock? Well, the company’s balance sheet is flawless as it boasts a debt-to-equity ratio of 0%. For that reason, I’ve got no doubts that Pinterest would be able to ride out a potential recession with its cash and equivalents of $2.66bn.

Most importantly, the firm is still in innovation mode and is expected to continue its aggressive growth under Ready’s leadership, with plenty of features still not fully rolled out (Shuffles, seamless checkout, product tagging, and more).

Moreover, Goldman Sachs recently upgraded its rating for Pinterest from neutral to buy, with a price target of $31. Overall, it has an average ‘buy’ rating and a price target of $26.50. Therefore, I’ll be buying more Pinterest stock while it sits at its current levels.