City Developments Limited (CDL) is a global property and hotel conglomerate that finds its properties in 106 locations across 29 countries. Its geographically diverse portfolio also comprises a multitude of properties ranging from shopping malls to offices; and from hotels to serviced apartments.

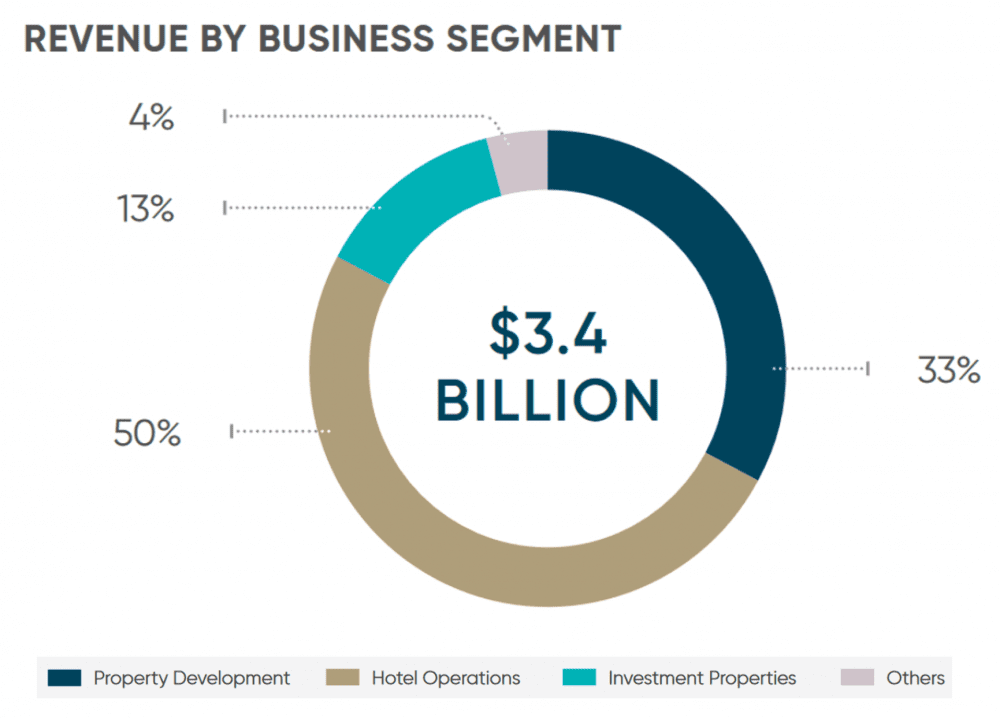

CDL reports three main business segments: Hotel Operations, Property Development, and Investment Properties. Of these three, Hotel Operations is the largest segment and contributed 50% of CDL’s total revenue in FY2019.

Source: City Developments 2020 AGM presentation slides

Undoubtedly, the hotel sector has been hit quite hard due to travel restrictions imposed due to COVID-19. With CDL deriving around half of its revenue in 2019 from its hotel operations, I wanted to find out the extent of the impact COVID-19 had on CDL’s business operations.

Hence, I tuned in to CDL’s virtual AGM to find out more. Here are 10 things I learned from the 2020 City Developments AGM:

1. CDL’s revenue decreased by 18.8% year-on-year to S$3.4 billion. The decrease in revenue in FY2019 is due to the high base effect where CDL’s revenue in FY2018 was boosted primarily from completed projects including New Futura, Gramercy Park, and The Criterion EC, in which their entire revenue was recognised upon their Temporary Occupation Permit (TOP). A portion of its revenue was also derived from overseas projects including Hong Leong City Center (HLCC) in Suzhou and Park Court Aoyama The Tower in Tokyo upon the handover of units following their completion.

In FY2019, CDL had fewer projects for sale. Main revenue contributors for FY2019 were The Tapestry and Whistler Grand projects, whose revenue and profits were recognised progressively based on their stage of construction, along with the sale of balance units in completed projects including Gramercy Park, New Futura, Hong Leong City Center (HLCC), and Shanghai Hongqiao Royal Lake.

This reflects the lumpy nature of the property development business where revenue is recognised differently for different types of properties. As shown above, the revenues for some properties were recognised progressively based on their stage of construction while some were recognised only upon TOP.

2. CDL’s EBITDA decreased by 5.2% y-o-y to S$1.1B, in comparison to its 18.8% dip in revenue. This is because revenue from CDL’s joint venture development projects including South Beach Residences, Boulevard 88, and Brisbane’s Ivy and Eve project are not included in the group’s revenue. However, they are included in the group’s earnings, thereby providing an increase towards EBITDA.

3. CEO Sherman Kwek shared that CDL continues to seek opportunities outside of the Singapore market to build a geographically diversified portfolio. He added that COVID-19 was a timely reminder of the importance of geographic diversification as a buffer against black swan events. My personal thoughts, however, was that a global pandemic like COVID-19 would be hard to escape and adversely affect all geographic markets.

Source: City Developments 2020 AGM presentation slides

4. In FY2019, CDL continued to strengthen its international footprint in key overseas markets. CDL expanded into the rental apartment segment by acquiring a Private Rented Sector freehold site in Leeds and four freehold rental apartment projects in Osaka. CDL’s rental apartment projects might benefit from the proposed opening of an integrated resort in Osaka, which can draw more visitors to the Japanese city. Having said that, the planned opening of the resort in Osaka has been pushed back to 2027 due to COVID-19 delaying bidding processes. CDL has also grown its Australian portfolio by acquiring ASX-listed Abacus Property Group’s residential division comprising three freehold residential sites.

5. CDL’s Singapore office and retail properties had committed occupancy rates of 90.9% and 94.4% respectively. As at 31 March 2020, the occupancy rate of CDL’s 13 Singapore office properties is slightly above that of Singapore office average (89.0%). The occupancy rate of CDL’s 9 Singapore retail properties is also slightly above that of Singapore’s retail properties (92.0%).

Fifty percent of CDL’s office space leases are due to expire over the next three years, but the CEO feels that CDL’s lease expiry profile for its office properties are well-managed. CDL’s lease expiry for its retail properties are more spread out with an average of 5.0% of retail space expiring annually over the next five years.

Source: City Developments 2020 AGM presentation slides

6. CDL has a well-spread debt maturity profile. With the exception of FY2022 where 38% of CDL’s debt is due for expiry, not more than 20% of its debt is due for expiry in any of the years ahead. The huge increase in debt expiring in FY2022 is due to five of CDL’s projects completing that year when their project refinancing loans will come due.

Source: City Developments 2020 AGM presentation slides

7. CDL’s property development business segment was negatively impacted by lockdown and restriction measures caused by COVID-19. In CDL’s Singapore and overseas markets, residential sales slowed, construction works were halted, and sales galleries were closed due to lockdown measures in view of the pandemic. The number of property units sold in Singapore by CDL decreased by 23% from the first quarter of 2020 to the 2nd quarter of 2020. However, CDL tries to ensure that residential sales can still continue despite temporary showflat closures by turning to digital marketing initiatives such as virtual tours and online sales presentations.

8. CDL’s retail and F&B outlets have been badly hit. There were widespread business closures in Singapore during the circuit breaker where around 80% of retail tenants paused business operations. Over S$23 million of rental and property tax rebates had to be provided to tenants. In CDL’s Thailand and China retail malls, rental rebates were also provided to tenants. A total of S$30 million in rental relief and support were given to CDL’s Singapore and overseas tenants in the retail sector.

9. CDL’s hotel operations have also been severely impacted by travel restrictions imposed due to COVID-19. As of 21 June 2020, 23% of CDL’s 152 hotels worldwide are closed. CDL’s first quarter performance was dismal due to COVID-19 — its global occupancy rate was 52.1% (down by 17.9% y-o-y), global RevPAR decreased by 27.0% y-o-y, and its global average room rate decreased by 2.0% y-o-y.

10. CDL has acquired a 51% joint controlling stake in Sincere Property Group for RMB4.39 billion (about S$0.88 billion). CDL also has a call option exercisable in 2022 for an additional 9% stake at the same entry price. CDL’s entry valuation was rather attractive, at almost 50% below the Sincere’s NAV. The attractive valuation was probably due to the economic uncertainties borne out of existing US-Sino geopolitical tensions and the COVID-19 pandemic.

With this, CDL’s presence in China grows from three cities to 18. Sincere’s investment properties are similar to that of CDL’s with 22 of its 27 properties coming from the retail and office space. CDL can also access the Sincere’s 9.2 million square metres development land bank, with 64 development projects across mostly Tier 1 and 2 cities in China.

The CEO shared that it was important that it acquired a major player in the Chinese property market so that it would be able to reap economies of scale and synergies in the market. There is no point in CDL venturing into the Chinese market as a fringe player.

The fifth perspective

City Developments is one corporation that’s facing the full brunt of COVID-19. Its retail and hotel segments are suffering from the loss of shoppers and tourists, and its property development arm has seen its construction projects delayed and new residential sales slow down due to the pandemic.

CDL’s share price fell nearly 45% to a low of $6.23 in March 2020 and has only partly recovered since then. CDL’s strong balance sheet will enable it to see through the crisis, but it will take a few years for the retail and hospitality sectors to return to pre-pandemic levels.

Liked our analysis of this AGM? Click here to view a complete list of AGMs we’ve attended »