Categories Analysis, Health Care

Consider these factors before investing in Eli Lilly and Company (LLY)

The stock declined this week after the company's cautious guidance failed to impress investors

The stock performance of Eli Lilly and Company (NYSE: LLY) has been exceptionally good this year, with the pharma giant defying the market crash and growing its market value consistently. It is one of the few stocks that managed to stay unaffected by the covid-related headwinds and the widespread selloff that has sent markets into a tailspin.

Resilience

The stock hit an all-time high this week, after making steady gains in recent months, but retreated after the company reported mixed third-quarter results. Investor sentiment was also hurt by the management’s weak guidance. Of late, there’ve been concerns over the slowdown in the sales of Lilly’s leading products, except its new diabetes drug, reflecting stiff competition and pricing pressure.

Read management/analysts’ comments on quarterly earnings reports

Interestingly, the stock has room for further growth even after the steady gains, if analysts’ bullish outlook is any indication. That makes it one of the safest investments in the current market scenario. Though Lilly is not a great dividend payer, it has raised the dividend regularly for over a decade.

Financial performance

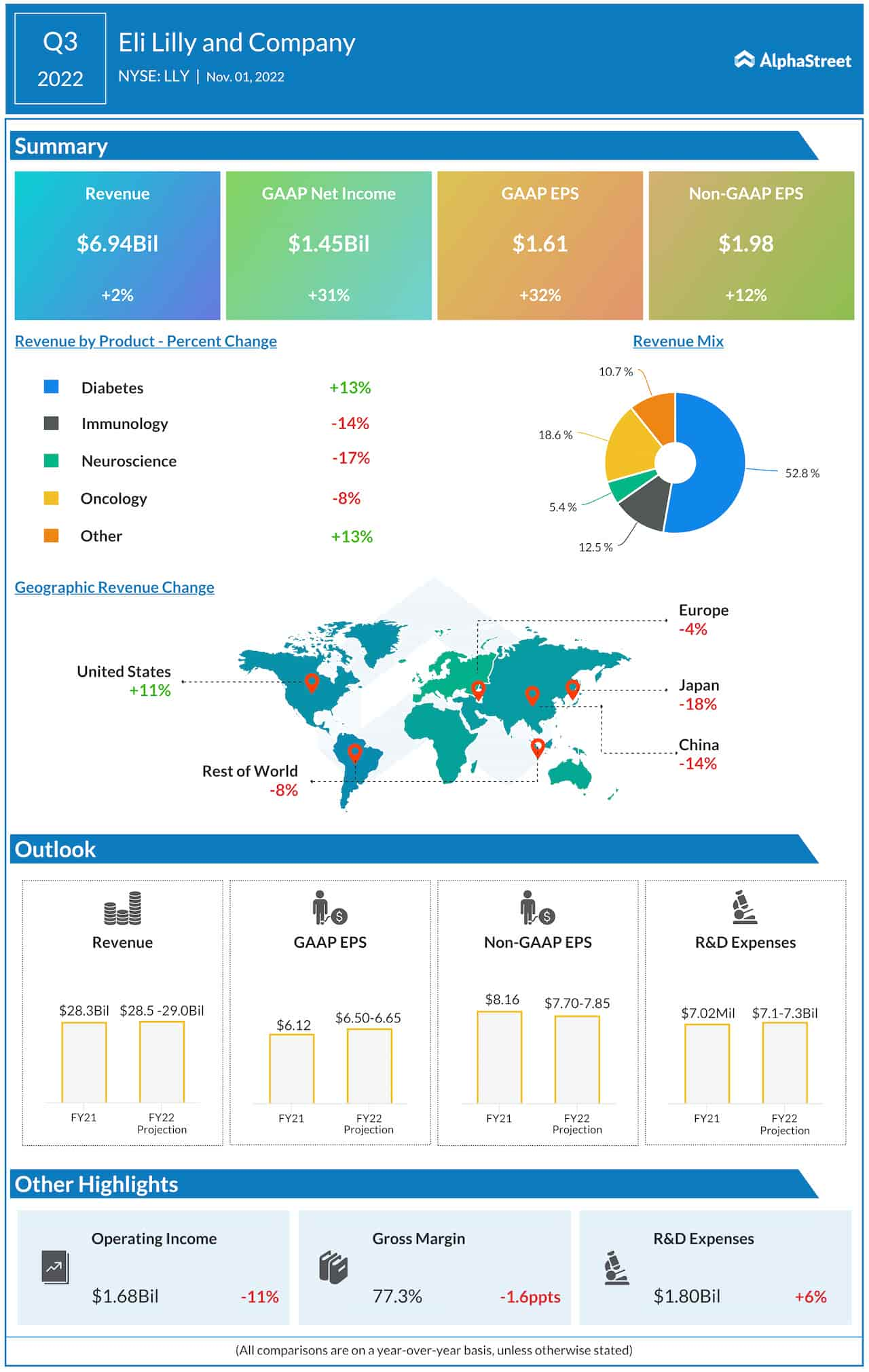

Though the company experienced volatility in bottom-line and revenue performance in 2021, with back-to-back earnings misses, things improved this year and it regained the lost momentum. In the September quarter, however, sales declined across all geographical segments except the U.S., amid weakness in non-diabetes products. Net sales edged up 2% to $6.94 billion, solely on the strength of the diabetes portfolio that grew by 13%. Adjusted earnings moved up 12% annually to $1.98 per share. Gross margin was broadly flat year-over-year.

The initial response to Mounjaro, the company’s type-2 diabetes treatment that was launched recently, has been encouraging. Meanwhile, there are concerns that at present Lilly is over-reliant on its diabetes products to generate revenue. But it has a healthy line-up of other products and a strong pipeline of drugs which are at advanced stages of development.

Pfizer: A look at the headwinds and tailwinds this pharma giant faces in the near term

“We have seen unprecedented demand for Mounjaro’s type 2 diabetes launch in the U.S., bolstered by strong efficacy and a positive customer experience. Availability of competitor’s incretin also is a key factor as we assess Mounjaro’s demand and supply. To meet this rapidly growing demand across our incretin business, we have plans to add substantial additional manufacturing capacity. In 2023, we expect the RTP site in North Carolina to become fully operational and that capacity, coupled with additional actions and extensions in other sites, will result in doubling Lilly’s incretin manufacturing capacity at the end of 2023,” said Lilly’s CFO Anat Ashkenazi at the Q3 earnings call.

Competition

Elsewhere, Lilly’s Alzheimer’s portfolio – with the latest candidate still in the development stage –faces increased competition from Biogen after the latter’s new formulation produced positive results. At the same time, Biogen’s success has come as an encouragement for Lilly’s Alzheimer’s program.

Lilly’s stock made strong gains during Wednesday’s session and hovered near the recent peak. It enjoys the distinction of growing in double-digits this year while the majority of Wall Street stocks suffered big losses.

Most Popular

JM Smucker (SJM) Q4 2024 Earnings: Key financials and quarterly highlights

The J.M. Smucker Co. (NYSE: SJM) reported its fourth quarter 2024 earnings results today. Net sales decreased 1% year-over-year to $2.2 billion. Net income was $245.1 million, or $2.30 per

Earnings Preview: Adobe likely to report higher profit and revenue for Q2 2024

Adobe Inc. (NASDAQ: ADBE) has always followed the path of innovation to maintain its dominance in the creative software market, and it is using the same strategy with generative artificial

Main takeaways from Dollar Tree’s (DLTR) Q1 2024 earnings report

Shares of Dollar Tree, Inc. (NASDAQ: DLTR) fell over 5% on Wednesday after the company delivered mixed results for the first quarter of 2024 and announced that it is considering