US Bancorp (NYSE: USB) on Wednesday reported a sharp decline in net profit for the fourth quarter of 2022, despite an increase in revenues.

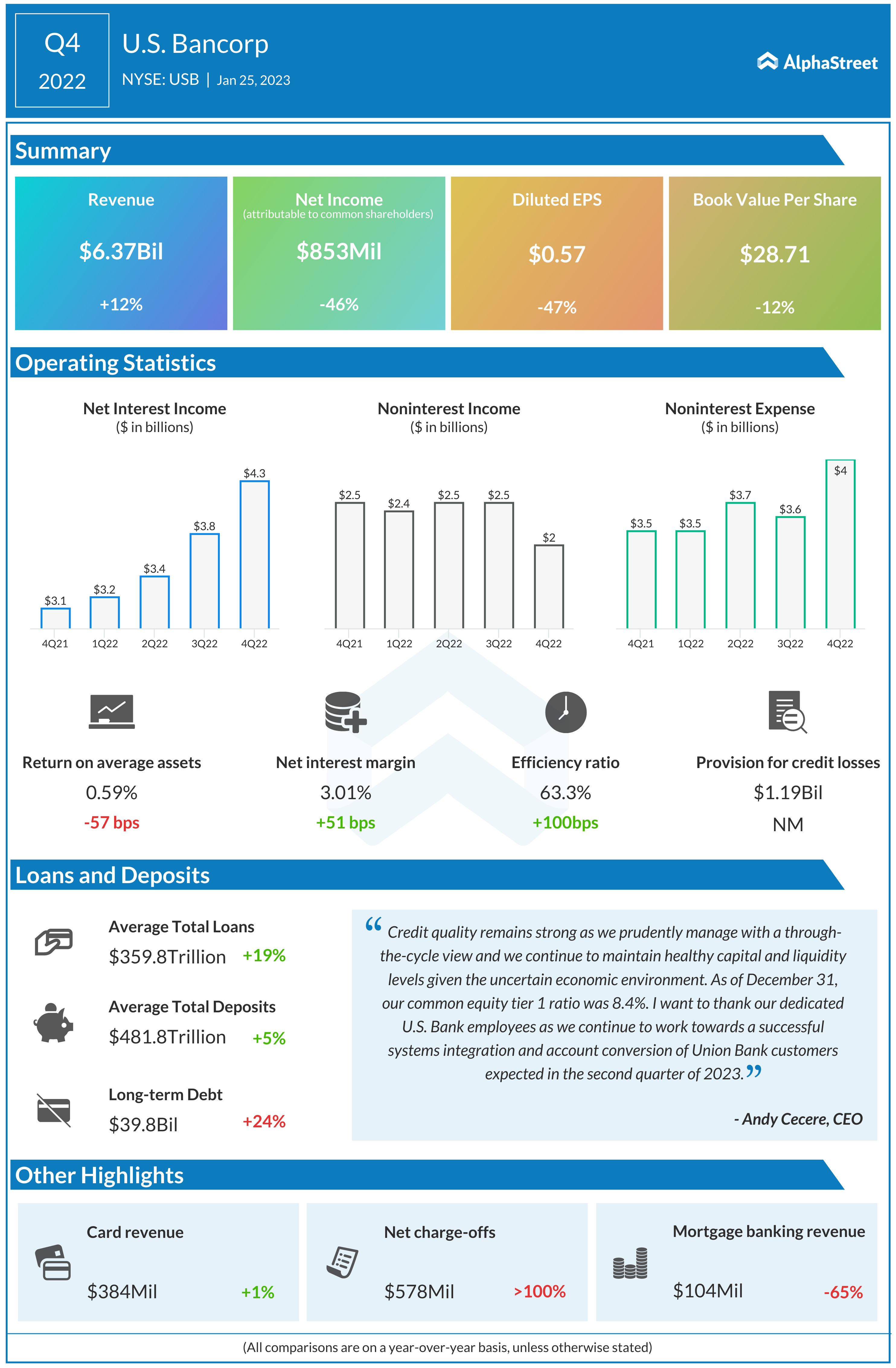

Net revenue increased 12% year-over-year to $6.37 billion in the fourth quarter. Net income applicable to the company’s shareholders was $853 million or $0.57 per share, compared to $1.58 billion or $1.07 per share a year earlier.

“Full-year results, as adjusted, were highlighted by strong pre-provision earnings growth, driven by solid net interest income, wider net interest margin, and positive operating leverage over 230 basis points. On December 1 we completed the acquisition of MUFG Union Bank, which meaningfully increased our market share in California by adding one million consumers, 700 commercial, and 190,000 business banking customers,” said the bank’s CEO Andy Cecere.

.

_________________________________________________________________________________________________________________

Stocks you may like:

_________________________________________________________________________________________________________________

Most Popular

Ulta Beauty (ULTA) Earnings: 1Q24 Key Numbers

Ulta Beauty, Inc. (NASDAQ: ULTA) reported net sales of $2.7 billion for the first quarter of 2024, up 3.5% year-over-year, driven by higher comparable sales, new store contribution, and growth

Costco reports stronger-than-expected Q3 earnings; revenue up 9%

Costco Wholesale Corporation (NASDAQ: COST), which operates a chain of membership warehouses, Thursday reported higher earnings and sales for the third quarter. Earnings also came in above estimates. Q3 revenues

Key takeaways from Hormel Foods’ (HRL) Q2 2024 earnings report

Shares of Hormel Foods Corporation (NYSE: HRL) plunged 8% on Thursday after the company delivered mixed results for the second quarter of 2024. Earnings beat expectations while revenues missed the