ITV (LSE:ITV) shares have made a positive start to 2023, posting a 7% gain to date. The company is one of the largest FTSE 250 constituents by market capitalisation. A return to the FTSE 100 index could be on the horizon if the share price continues to grow.

But the major appeal of this media stock for me is its 6% dividend yield. That’s far higher than the average yield offered by FTSE 350 shares.

So, if I wanted to target £100 in passive income each month, how many ITV shares would I need to buy? Let’s explore.

Dividends

The ITV final dividend for 2022 matched that of the previous year at 3.3p per share. However, the resumption of the company’s interim dividend meant the total payout for shareholders increased to 5p.

At today’s yield, to target £1,200 in annual dividend income, I’d need to invest £20,000 in the company — a sum that neatly fits within my Stocks and Shares ISA allowance. Currently, the ITV share price is 83.22p, which means I could buy a grand total of 24,001 shares with a £20,000 lump sum to invest.

That said, using up my entire annual ISA allowance to invest in one company isn’t my preferred strategy. I believe there are merits in portfolio diversification, and I’d seek to spread my money across a range of dividend shares, rather than concentrate all my spare cash into one company.

Nonetheless, the calculations above show the kind of investment I’d need to make in ITV shares in order to secure £100 in monthly passive income. Plus, these numbers could look even more attractive in the future, considering ITV’s ambition to grow the dividend over the medium term.

Where next for ITV shares?

The broadcaster’s full-year results for 2022 contained some encouraging numbers. External revenue saw an 8% uptick to reach £3.73bn. Growth was particularly encouraging in the ITV Studios division, with total organic revenue at constant currency climbing 14%.

The successful launch of a new streaming service, ITVX, bodes well for the future despite some analysts’ initial concerns the company would struggle to gain a foothold in a competitive market. Streaming now accounts for over a fifth of ITV’s total revenues — a considerable increase from its 13% share in 2021.

In its first two months post-launch, ITVX attracted 1.5m new registered users. It also helped to lift the company’s total streaming hours by 69% year on year. I’m excited to see how ITV taps into the substantial demand with new shows and films to expand its audience.

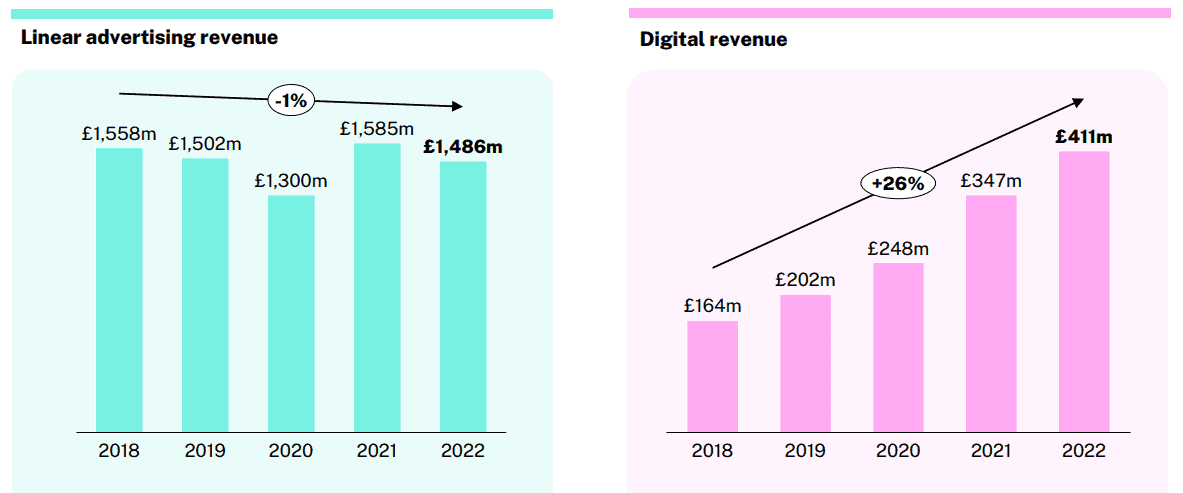

One concern is the slight decline in linear advertising revenue. A gloomy macroeconomic outlook might mean that ITV will continue to see sluggish activity in generating income from promotions.

At £1.49bn, total advertising revenue is below where it’s been for most of the past half-decade. However, consistent growth in digital advertising revenue assuages my concerns somewhat and I’m optimistic ITV can capitalise on this trend further in the coming years.

Should I buy this stock?

Although there are risks, I think ITV shares look attractively valued today. In addition, the bumper dividend yield is particularly tempting.

If I had some spare cash, I’d invest in the company today.