Consumer staples company Conagra Brands Inc. (NYSE: CAG), which owns popular brands like Marie Callender’s, Reddi-wip, and Slim Jim, has been able to beat headwinds like high inflation through prudent pricing actions and continued innovation. The company will be reporting third-quarter earnings next week.

In the past twelve months, Conagra’s stock mostly traded sideways — the highlight was the rise to a record high in January. Though CAG pulled back since then, it continued to trade above the long-term average. If the stock’s flat historical performance is any indication, it is unlikely to make such gains that would result in significant value creation in the near future.

The Stock

Those who buy the shares now might be disappointed. A better way to approach the stock is to keep an eye on it and wait for a suitable entry point. On the positive side, the valuation is cheap and it offers a high dividend yield of 3.6% which is well above the S&P 500 average.

Signaling that 2023 would be a better year than 2022, Conagra executives predict a double-digit increase in full-year adjusted earnings, which marks an improvement from last year when earnings declined about 10%.

Q3 Report Due

The company is set to report results for the third quarter of 2023 on Wednesday, April 5, in the morning. Experts estimate that earnings, adjusted for non-recurring items, increased 10% from last year to $0.64 per share in the February quarter. The average estimate for net sales is $3.09 billion, which is up 6%.

From Conagra Brands’ Q2 2023 earnings call:

“While our gross margin can vary quarter to quarter due to a range of internal and external factors, the strategic pricing actions we have successfully executed, combined with moderating inflation and our strong brands, position us well to recover and maintain a healthy gross margin going forward. Of course, inflation remains elevated in many areas, and we continue to closely monitor our costs just as we have in the past. We will continue to take appropriate inflation-justified pricing actions as needed.”

Financials

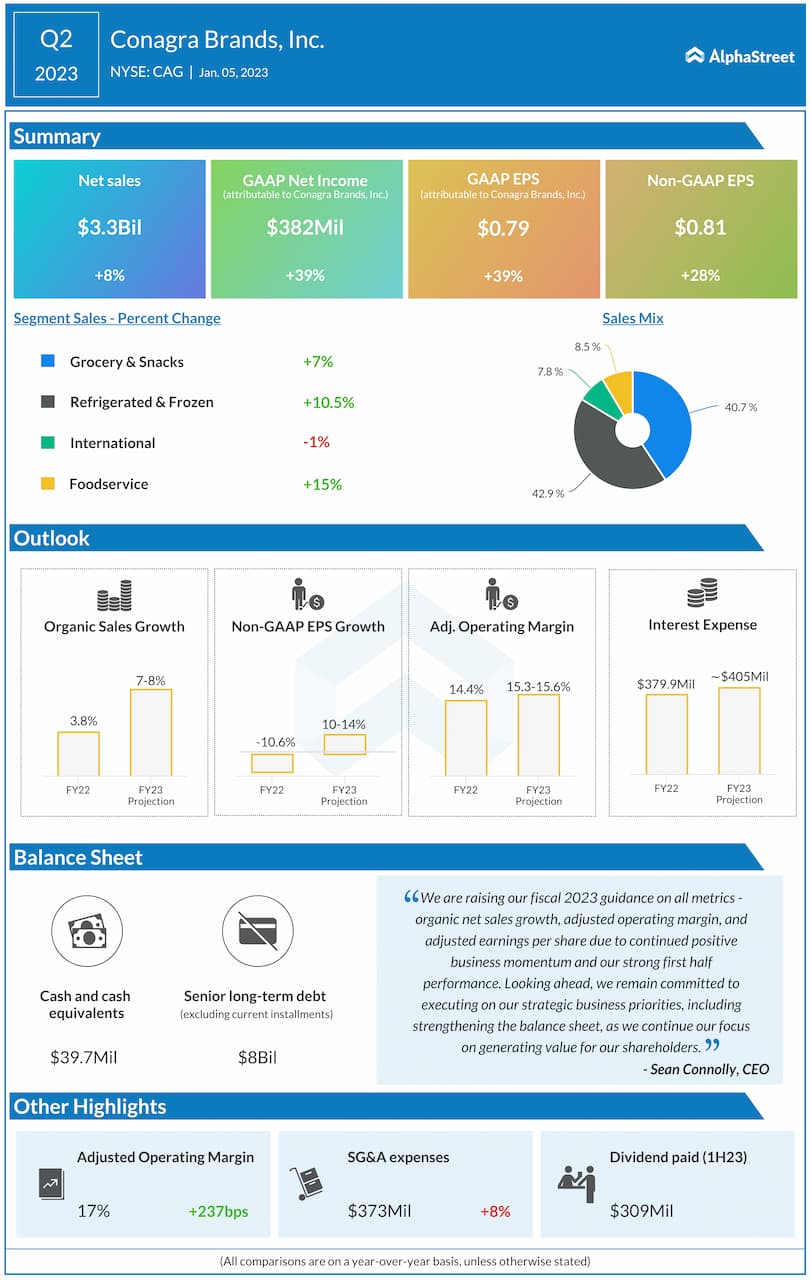

In the second quarter, continued strong performance by the grocery and frozen foods segments pushed up total sales by 8% to $3.3 billion, which is also above Wall Street’s projection. Except for international sales, which edged down by 1%, all operating segments registered revenue growth. As a result, adjusted profit climbed 28% to $0.81 per share and came in above estimates — the fourth consecutive earnings beat. Having ended the first half on an upbeat note, the management raised its full-year sales and profit outlook.

CAG is gaining strength ahead of the earnings and the uptrend continued this week, but the stock closed Thursday’s session lower.

Looking for more insights on the earnings results? Click here to access the full transcripts of the latest earnings conference calls!

Most Popular

Infographic: Key metrics from Estee Lauder’s (EL) Q3 2024 earnings results

The Estee Lauder Companies Inc. (NYSE: EL) reported its third quarter 2024 earnings results today. Net sales were $3.94 billion, up 5% from the prior-year quarter. Organic sales increased 6%.

YUM Earnings: Key quarterly highlights from Yum! Brands’ Q1 2024 financial results

Yum! Brands, Inc. (NYSE: YUM) reported first quarter 2024 earnings results today. Total revenues decreased 3% year-over-year to $1.59 billion. Same-store sales declined 3%. Net income increased 5% to $314

Pfizer (PFE) Q1 2024 Earnings: Key financials and quarterly highlights

Pfizer Inc. (NYSE: PFE) reported first quarter 2024 earnings results today. Revenues decreased 20% year-over-year to $14.8 billion. Reported net income declined 44% to $3.1 billion, or $0.55 per share,