Categories Health Care, Trending Stocks

Is it time to book profits from Moderna?

The stock has defied gravity; but has it achieved escape velocity?

Moderna (NASDAQ: MRNA) stock has soared a staggering 679% since the beginning of this year. If you did identify the potential of this COVID-19 vaccine frontrunner in the early days of the pandemic, you have probably made a fortune by now.

Standing way above numerous shattered resistance levels, has this stock finally hit a peak? What should the long-term investors do now?

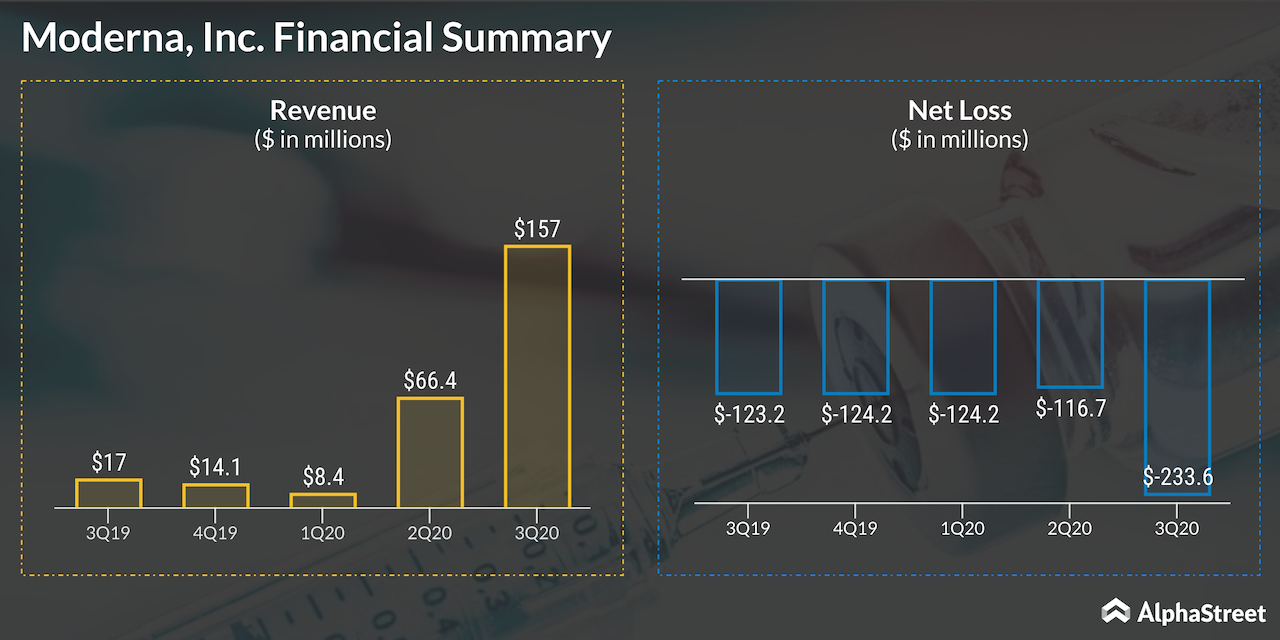

Unsustainable growth

November was a month of a mad run for the stock. MRNA has more than doubled in valuation in a very short span of 30 days, which is not sustainable irrespective of its growth potential. Apart from the natural correction that is likely to impact the rally in the coming days, more favorable reports from rivals Pfizer (NYSE: PFE) and Novavax (NASDAQ: NVAX) could mean tighter competition in the lucrative vaccine space, weighing further on the stock.

Separately, the growth that happened earlier this week did not make much sense either. There was a 20% spike in the share price after Moderna announced that it was reaching out to the FDA seeking clearance for the commercial sale of the vaccine. Since a rally was already underway following the announcement of the 94% efficacy rate, filing for approval should have been a non-event without much market impact. However, the market seems to have lost logic when it comes to vaccine news.

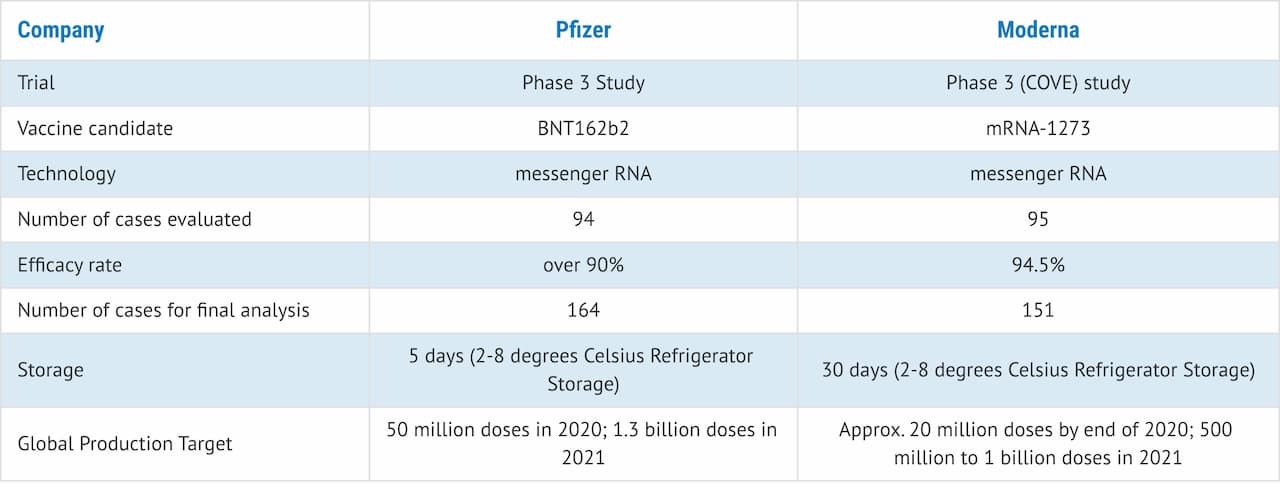

News from competitors

Pfizer has already received approval from The Medicines and Healthcare products Regulatory Agency (MHRA), Britain’s medicines regulator, for roll out in the UK. Around 800,000 doses are to be delivered to the UK by next week. Meanwhile, Novavax had recently announced the initiation of its phase 3 trials, though it has been pretty tight-lipped about the effectiveness and other details.

All this is likely to have contributed to Merck’s (NYSE: MRK) decision to sell its stake in Moderna this week. Merck has booked its profits from the $50-million investment, which would be reflected in the pharma giant’s balance sheet in the upcoming quarter.

Analysts are also of a similar opinion. The 12-month average price target on the stock is $123.20, which is at a 15% discount from Wednesday’s trading price.

But don’t get us wrong here. By no means we suggest that Moderna bulls should give up their stake. The pipeline outside the COVID-19 vaccine is promising and the company’s prospects look bright in the long run. But this might be a good opportunity to book some good profits and splurge on Christmas gifts.

______

(Disclaimer: The opinions stated in the article are of the author alone.)

Most Popular

INTU Earnings: Intuit Q3 2024 revenue and adj. profit top expectations

Intuit Inc. (NASDAQ: INTU) Thursday reported an increase in adjusted earnings and revenues for the third quarter of 2024. The results also exceeded analysts' estimates. At $6.74 billion, the Mountain

After blowout quarter, Nvidia (NVDA) looks set to continue riding the AI wave

Shares of NVIDIA Corporation (NASDAQ: NVDA) rallied this week after the semiconductor giant reported robust first-quarter numbers. Being a first mover in artificial intelligence chips, the company is spearheading the

Target Corp. (TGT): A brief look at the retailer’s performance in Q1 2024

Shares of Target Corporation (NYSE: TGT) rose over 1% on Thursday. The stock has dropped over 11% in the past one month. The company delivered mixed results for the first