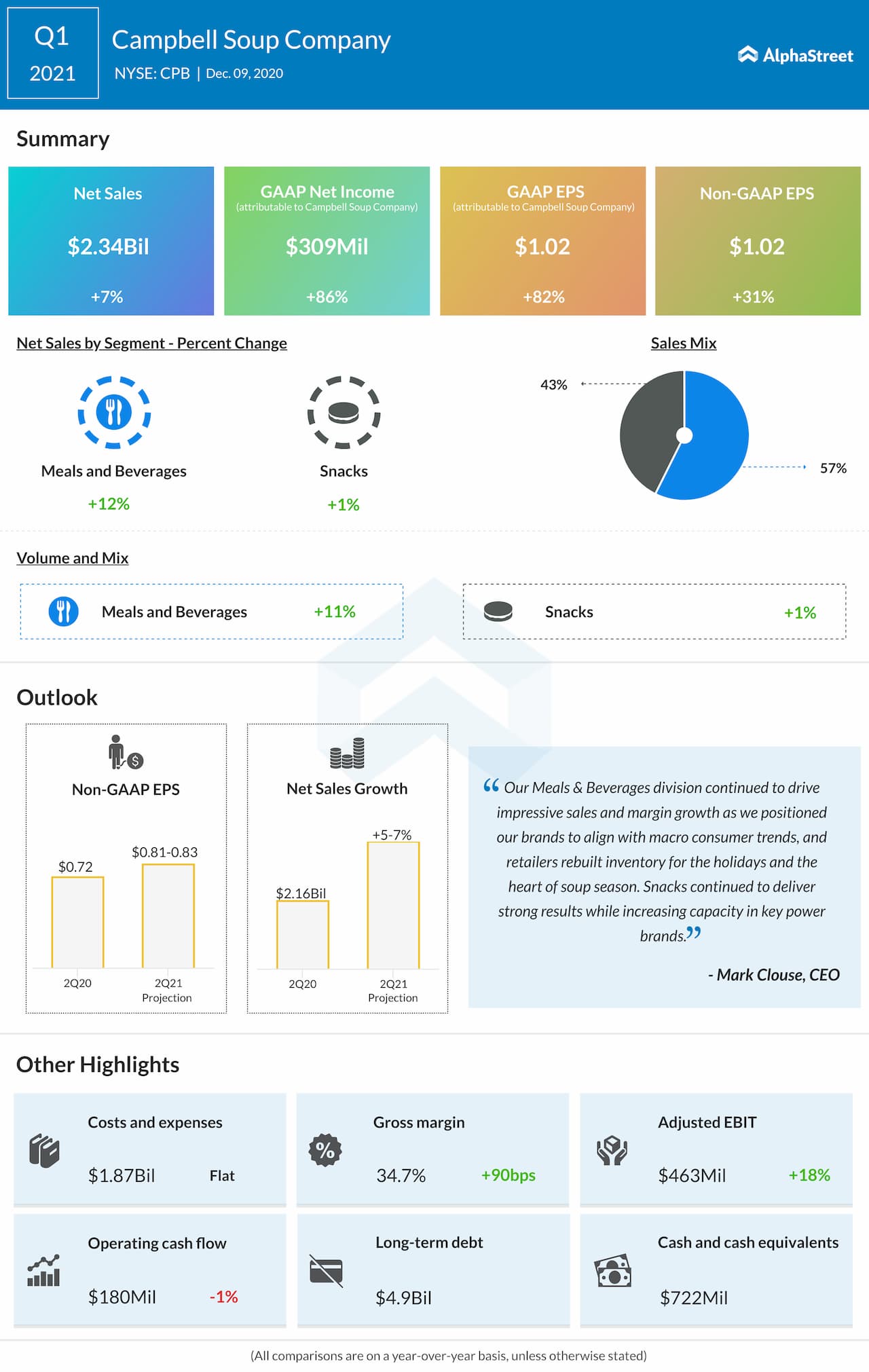

The COVID-19 pandemic has driven sales growth for several food companies as people turn to quick meal kits and snacking options while spending more time at home. Campbell Soup Company (NYSE: CPB) was no exception. The company reported strong results for the first quarter of 2021 beating market estimates but its weak guidance raised some concerns.

Strong performance

Sales in the Snacks segment increased 4% on an organic basis, with gains across the majority of its brands. Snacks witnessed increased demand due to the rise in at-home consumption. Campbell not only saw increased household penetration during the quarter but also strong retention rates in this division.

In Meals & Beverages, soup sales jumped 21% with rises in household penetration and retention rates. Condensed soups delivered double-digit sales growth and the company believes that its soups and meals products will continue to benefit from the trend of people cooking at home.

Campbell believes that the changes in consumer behavior during the pandemic that has led to cooking more easy meals at home as well as more eating and snacking at home are likely to continue even after the health crisis subsides thereby allowing it to retain a meaningful portion of the customers it gained during this period.

Will the favorable trends continue?

Despite Campbell’s optimism, there are concerns that the rapid jump in demand and sales experienced by food retailers during the pandemic period is likely to normalize once the pandemic subsides and things go back to normal. As restrictions ease, some retailers are seeing a slowdown in sales compared to their previous quarters this year.

In Campbell’s case, the question is once vaccines become available and things come under control, will people continue to cook at home or go back to their old habits of eating out. This could go either way. People could continue to cook meals at home thereby being cost-efficient and health-conscious or they could opt to dine out due to busy schedules. Currently the trend seems to point to the latter.

During the first quarter, Campbell’s organic sales grew 8%. This was down from the 12% seen in the fourth quarter of 2020 and 17% in the third quarter. This seems to indicate a slowdown as restrictions ease.

For the second quarter of 2021, the company provided adjusted EPS guidance of $0.81-0.83, which was below analysts’ projections of $0.84. This did not go down well with the Street and the stock is still bearing the brunt. It remains to be seen if the momentum seen in demand and sales continue over the coming months.

Cost savings and dividend

As part of its multi-year cost savings initiatives, Campbell generated $15 million in incremental savings during the quarter. This brings overall savings to-date to $740 million. The company expects to achieve $60-70 million during the remainder of FY2021 and is on track to deliver its cumulative target of $850 million by the end of FY2022.

Campbell also increased its quarterly dividend by 6% to $0.37 per share, or $1.48 on an annualized basis. The dividend is payable on February 1, 2021 to shareholders of record on January 9, 2021.

Click here to read the full transcript of Campbell Soup Q1 2021 earnings conference call

Looking for more insights on the earnings results? Click here to access the full transcripts of the latest earnings conference calls!

Most Popular

Take-Two Interactive Software (TTWO): Key takeaways from the Q4 2024 earnings report

Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) stayed green on Friday. The stock has gained 7% over the past 12 months. The company reported its fourth quarter 2024 earnings

Take-Two Interactive Software (TTWO) Earnings: 4Q24 Key Numbers

Take-Two Interactive Software, Inc. (NASDAQ: TTWO) reported net revenue of $1.40 billion for the fourth quarter of 2024, which was down 3% year-over-year. Net loss was $2.90 billion, or $17.02

Applied Materials (AMAT) Earnings: 2Q24 Key Numbers

Applied Materials, Inc. (NASDAQ: AMAT) reported revenue of $6.65 billion for the second quarter of 2024, which remained flat year-over-year. GAAP net income increased 9% to $1.72 billion and EPS