We saw that the US small cap index, such as the Russell 2000, put in two consecutive days of 3% move due to favourable commentary from the FOMC meeting.

I would suggest investors don’t chase this.

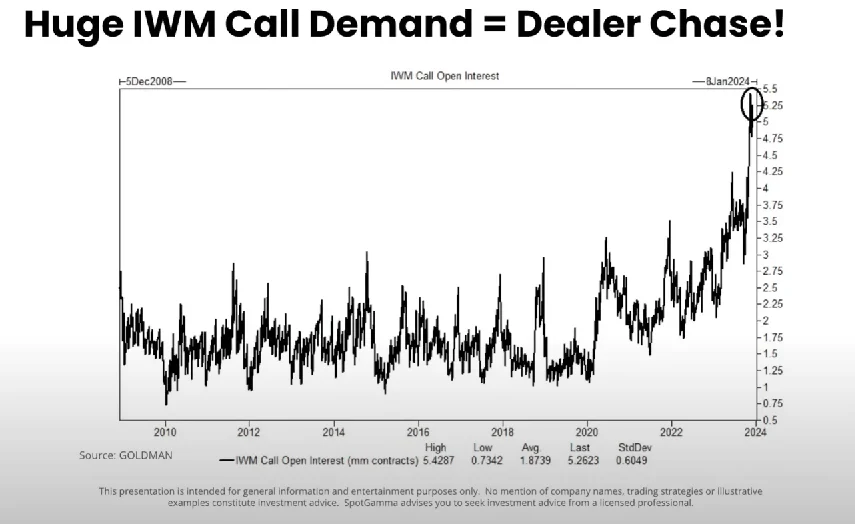

In a recurring episode of Excess Returns OPEX Effect, Brent Kochuba explains that more calls are being bought than in the past. Traders are trying to position for a period where small cap are seasonally stronger. The other reason is that they are betting on a broadening out of this market improvements to other sectors of the economy.

If there are so many call options on the Russell 2000 ETFs, it means that options market makers or dealers are selling a lot of call options to these people. The options market makers’ objective is to make money but also remain relatively market-neutral. Since selling call options is a bearish position they need to “neutralize” this by a bullish position which is to buy the underlying index. That buying action is itself bullish and when traders see price up, they buy more call options, and more call options means more buying from market makers and you get this kind of crazy up moves.

This option force will end upon option expiry which takes place after this Friday (this evening essentially).

What happens next week is anyone’s guess.

Brent explains that the options skew, which is the pricing of call and put options is positive towards the call side (call options at the same delta cost more than the put options at the same delta), which is less normal which indicates there is more interest to be bullish than normal.

There may still be enough forces for the rest of the year but this seasonal bullish or bearish stuff is not always accurate. There are traditional seasonal forces that are in place, but these seasonal forces can be overwritten by changes in the market as the market is a machine that consistently tries to price in things. If suddenly there is a sudden sign that the market is not doing as well as it is, then the market will price in greater extreme bearishness in the next six months.

However, if you are thinking about adding because you feel that this is a good time to add, perhaps don’t do it right now because the move up may be due to some forces that are less fundamentals driven.

Some more on the small cap seasonality:

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

lim

Friday 15th of December 2023

It is always better to "Buy after a crash" than to "Buy after a rally" :)