Lloyds (LSE:LLOY) shares are currently anchored well below where they were five years ago. To make matters worse, investors hoping the new year would bring good news will have been bitterly disappointed by a sharp 12% fall in the Lloyds share price since 1 January.

So, is the Black Horse Bank now trading in bargain territory? Or is this stock a value trap to avoid?

Here’s what the charts say.

Valuation

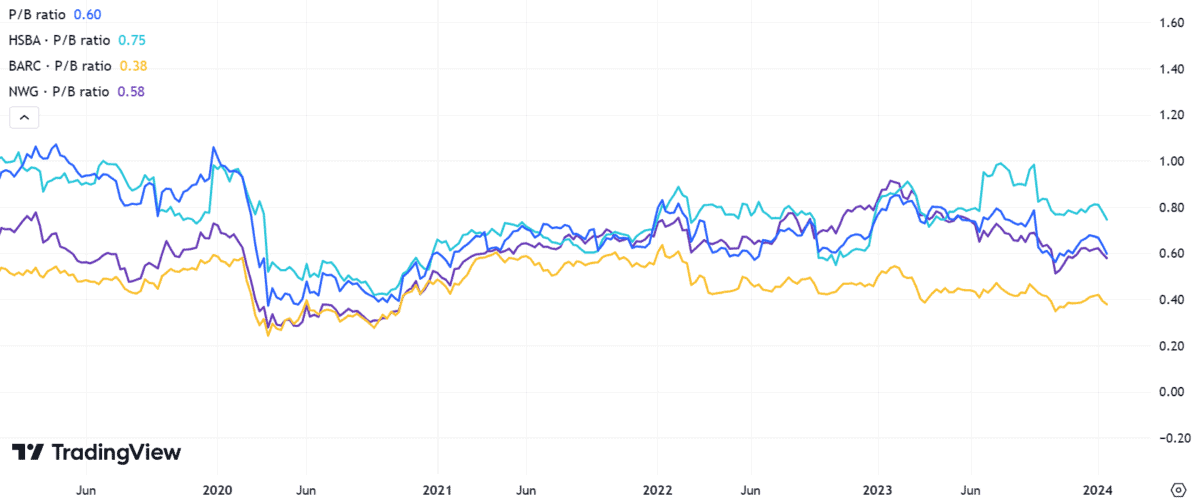

Using the price-to-book (P/B) ratio is traditionally a good way to value bank shares.

That’s because this tool accounts for the book value of lenders, essentially measuring the net value of their assets after deducting liabilities.

Since banks have long investment periods, the P/B ratio can often be more relevant in assessing their performance than the price-to-earnings (P/E) ratio.

On this metric, the Lloyds share price doesn’t stand out as particularly cheap compared to its FTSE 100 rivals. Indeed, NatWest and Barclays both have lower P/B ratios at present, although HSBC‘s is higher.

Overall, investors might reasonably conclude there could be better bargains to be found elsewhere in the banking sector at present.

Return on equity

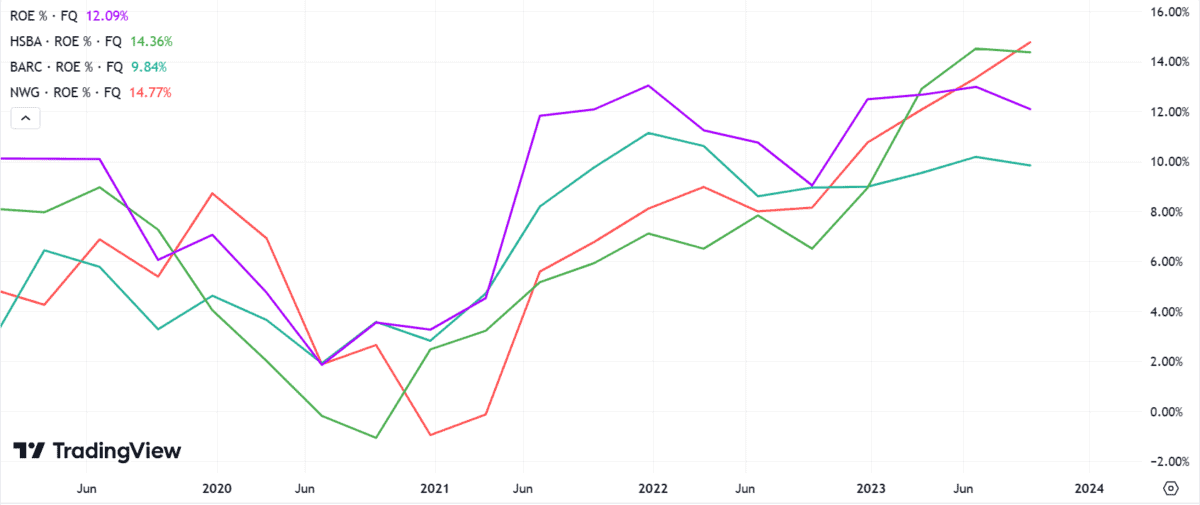

Beyond the P/B ratio, it’s also important to consider the return on equity (ROE) ratio to gauge a bank’s growth prospects.

In this regard, Lloyds has lead the way out of the quartet of major FTSE 100 banks for the past couple of years.

However, that situation has recently reversed. Lloyds has experienced the sharpest decline in its ROE according to the latest quarterly data. It now trails both NatWest and HSBC.

Dividends

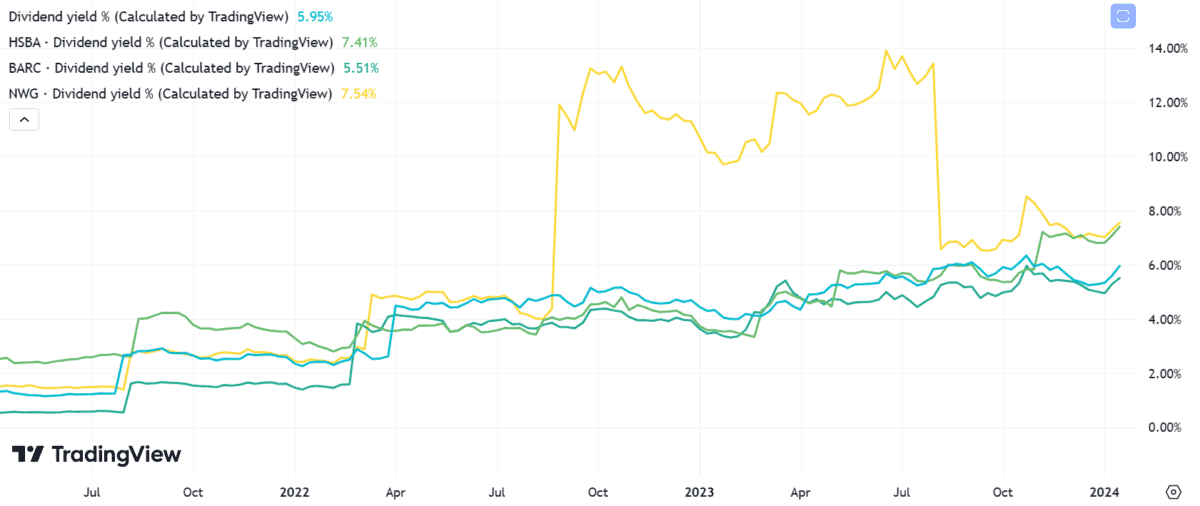

On the passive income front, Lloyds shares compare favourably to the FTSE 100 index as a whole. The dividend yield, just shy of 6%, is well above the Footsie average of 3.8%.

However, set against the wider industry, those shareholder payouts don’t look too remarkable. Both NatWest and HSBC offer considerably higher yields.

Furthermore, while Barclays’ yield is lower, its forecast dividend cover is stronger at 3.2 times anticipated earnings, compared to just 2.2 times for Lloyds.

Time to sell?

The charts above will do little to soothe the concerns of shareholders who have had to exercise plenty of patience in recent years. I’m one of those investors in that position.

To compound problems, Lloyds is particularly exposed to the fallout from a Financial Conduct Authority investigation into bad practices surrounding motor loan commissions. The potential fine could total £1bn.

However, on the other hand, Morgan Stanley analysts predict the Lloyds share price could eclipse 85p in 2024. According to this broker forecast, the lender is the top UK banking pick right now.

Indeed, as Britain’s largest mortgage lender, Lloyds is particularly exposed to the fortunes of the UK economy. Other FTSE 100 banks have a greater degree of international diversification.

As such, the stock could be well-placed to benefit from any upside surprises in UK GDP figures. Currently, the prospect of a potential recession could be holding back growth in the Lloyds share price.

However, the charts don’t paint the prettiest picture currently. I’ll continue to hold my shares for now, but if financial results on 22 February disappoint, it might be time for me to trim my position.