The FTSE 250 has underperformed other major share indexes as worries over economic weakness and political instability in the UK have risen. It’s a development that means I can build a winning portfolio of dividend shares that doesn’t cost me the Earth.

Take the two dividend stocks discussed here, Tritax Big Box REIT (LSE:BBOX) and NextEnergy Solar Income (LSE:NESF). As the table below shows, each trades on an attractive price-to-earnings (P/E) ratio. On top of this, their dividend yields comfortably beat the 3.4% average for FTSE 250 shares.

| COMPANY | FORWARD P/E RATIO | FORWARD DIVIDEND YIELD |

|---|---|---|

| Tritax Big Box REIT | 18.4 times | 4.7% |

| NextEnergy Solar Fund | 9.3 times | 10% |

Passive income of £1,430

Past performance is no guarantee of future returns. And dividends are never a certainty. But if City estimates prove correct, these top stocks could deliver with an abundant passive income.

Based on their current dividend yields, £20,000 invested in them could provide me with a passive income of £1,430. I expect them to deliver a steadily growing dividend over time, too. Here is why.

Boxing clever

Chart created with TradingView

Real estate investment trust (or REIT) Tritax Big Box carries a higher P/E ratio than most other FTSE 250 stocks. But don’t be fooled. It actually offers solid value for money on paper.

As the chart above shows, the business — which owns and operates a portfolio of warehouses and logistics hubs — has historically traded on a P/E ratio in the early to mid-20s. Today, it trades on a multiple closer to 18 times.

REITs can be brilliant ways to make a second income. They have a steady flow of income that helps them to finance dividends year after year. During 2023, Tritax delivered its tenth consecutive year of 100% rent collection.

They are also subject to rules that dictate at least 90% of annual rental profits must be paid out in the form of dividends.

I’m also excited by Tritax specifically because it lets out its properties to stable blue-chip companies like Amazon, Ocado and Morrisons. This gives earnings (and by extension dividends) a further layer of protection.

Tritax’s share price could remain under pressure if interest rates remain above normal levels. But on balance I think it’s a top dividend stock to own.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Sunny outlook

NextEnergy Solar Fund is another UK share whose net asset value (NAV) and borrowing costs are impacted by high interest rates. Profits, meanwhile, are vulnerable to unfavourable changes in the weather.

However, I’m still expecting this renewable energy stock to deliver those big dividends City analysts are forecasting for the upcoming financial year (ending March 2024).

One reason is that, like Tritax, it generates a reliable flow of income during good and bad times. Electricity usage remains broadly stable from year to year, meaning demand for its green energy follows suit.

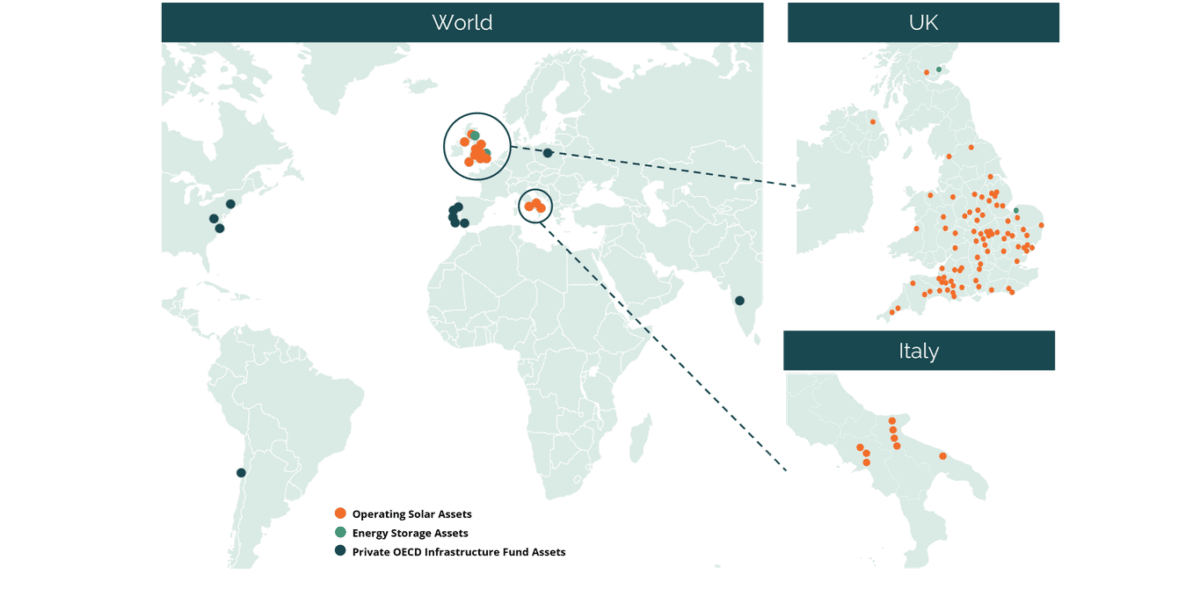

Furthermore, NextEnergy — which chiefly operates solar farms in the UK and Italy — has long-term power purchase agreements (PPAs) in place with utilities companies. These guarantee a fixed price for the electricity the firm produces, which in turn provides solid earnings visibility.

I expect the business to deliver a steadily growing dividend over the long term, too, as demand for its green energy accelerates.