The rush for companies to grab artificial intelligence (AI) market share has led to a surge in demand for the hardware that powers these powerful models and applications. Super Micro Computer (SMCI -2.79%) has been a significant benefactor, and the stock's exponential rise over the past year reflects that.

After soaring from under $100 to over $1,200 per share, the stock -- and the broader market -- have taken a breather in recent weeks.

Extreme price action can intimidate investors from buying a dip because they fear that the higher a stock soars, the further it will fall. But that could be an unwarranted fear in this case. Here is why Supermicro, as it is also known, could be a brilliant buy today.

The numbers support Super Micro Computer's meteoric run

It's hard to find a stock's price chart this impressive; gaining over 1,000% can take most stocks decades to accomplish, so hitting such a milestone in under 18 months is remarkable -- and rare. Artificial intelligence is the primary catalyst for this. According to some studies, AI's long-term potential is enormous ... a future trillion-dollar industry. Investors are scrambling to position their portfolios for that growth.

Supermicro sells modular server systems and components for data centers. This is an ample opportunity because most companies don't want to design these massive computer systems from the ground up; they want quick, turnkey computing power, which is right in Supermicro's wheelhouse.

Stock prices can often respond to expectations of what might happen, and the tremendous AI potential could justify some stock surges. Fortunately, hard numbers already support Supermicro's surging share price. The company has entered a growth spurt that saw its revenue grow 103% year over year in the second quarter of its 2024 fiscal year and 73% quarter over quarter. Management believes that growth is accelerating, guiding for over 200% year-over-year growth for the upcoming quarter.

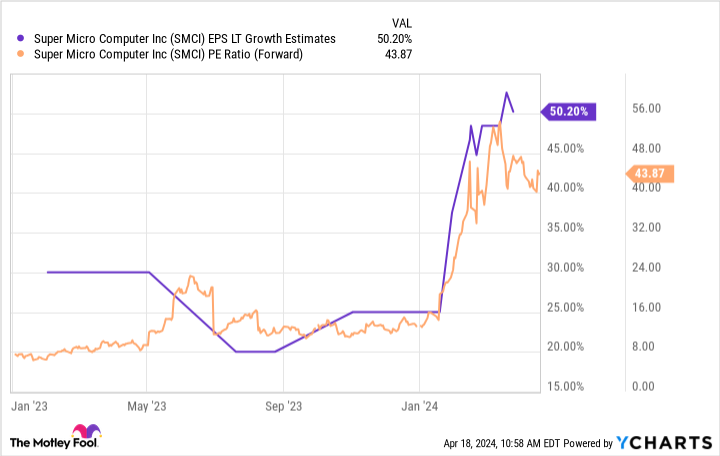

Analysts believe the company will earn approximately $22.15 per share this fiscal year, which values the stock at a forward P/E of 43, despite its monstrous run over the past 18 months. In other words, Supermicro has already grown into the large shoes the market thinks it should own.

Looking to the future

Investing is about looking to the future, and you might need sunglasses to see Wall Street's bright expectations for this company. Analysts believe Supermicro will grow earnings by an average of 50% annually over the next three to five years.

That's a high bar, but one that Supermicro seems able to clear. After all, revenue is growing at a triple-digit rate. The business is already profitable, so that should largely trickle down to the bottom line. It doesn't even factor in additional growth levers like share repurchases that management could enact as its cash balance swells.

SMCI EPS LT Growth Estimates data by YCharts

How likely is this to happen? Studies show that AI uses tremendous computing power, naturally stimulating demand for more data centers. According to a U.S. data center market report from Newmark, the footprint for data centers in America will double by 2030 due to demand for AI applications. Supermicro has noted that demand for its systems is growing faster than the broader industry, which bodes well for growth over the next five years.

Is Super Micro Computer a buy?

Considering its massive price movement, one might assume that Supermicro is expensive, but the numbers show that's not true. Using the PEG ratio to value the stock based on its expected growth illustrates this. I generally look for PEG ratios of 1.5 or less, and Supermicro's PEG ratio is only 0.8 today. Assuming Supermicro delivers on analyst estimates, the stock is a bargain today for long-term investors and an easy buy.

What if the company's performance falls short of expectations? Suppose actual long-term earnings growth is half of estimates, just 25% annually. The resulting 1.7 PEG ratio would still be somewhat reasonable for buyers today. That means that Supermicro would likely have to fall on its face to not generate satisfactory investment returns over the long term.

Investing offers no promises, but you can help your odds of success by finding situations where the reward is greater than the risks involved. The numbers show that Supermicro is one such opportunity.