I’d love a second income. I’m sure most of us would. So, how could we turn just £8,000 into a second income worth £6,960 annually?

It’s not about dividends, for now

The trick to turning £8,000 into a second income isn’t dividend stocks, it’s about growing our portfolios into something much bigger. In the near term, we have to accept that £8,000 invested in stocks and shares isn’t going to give us a second income worth much more than £600 a year.

However, if we invest wisely in growth-oriented stocks, we could see our £8,000 grow much quicker. Personally, I like to use a data-driven approach, and I invest most of my capital into companies with strong price-to-earnings growth (PEG) ratios.

The PEG ratio is calculated by dividing the forward price-to-earnings (P/E) ratio by the expected annual growth rate of the medium term. For example, AppLovin (NASDAQ:APP) currently trades at 16 times forward earnings, but the expected growth rate is 20% annually. In turn, this gives us a PEG ratio of 0.8. Anything under one is very attractive.

This is the type of stock driving my portfolio forward. In fact, I’m already up 113% on AppLovin. But the secret sauce is compound interest. If I’m reinvesting my returns, my portfolio will grow faster and faster over time.

A little more on AppLovin

AppLovin recently beat earnings estimates for the first quarter of 2024 — it’s the company’s fourth straight earnings beat.

AppLovin empowers mobile app creators to succeed. It provides tools for marketing, advertising, data analysis, and even publishing apps. It also runs Lion Studios, which helps developers build and publish winning mobile games. The firm also invests in other game developers and operates a diverse portfolio of free-to-play mobile games.

Investors may be concerned about the company’s record for revenue growth. It was pretty shaky with revenue annually falling backwards during a couple of quarters in 2022 and 2023.

However, the release of AXON 2.0 appears to be driving the company’s recent surge. The AI engine helps boost customers’ earnings by recommending apps for individuals based on their activities and preferences.

In short, the better AppLovin’s customers do, the better the California-based company does itself. According to management, AXON 2.0 hasn’t been integrated fully by all its gaming clients, suggesting more growth to come.

When is it time for a second income?

When do we stop investing for growth and start taking a second income? Well, that’s up to us individually.

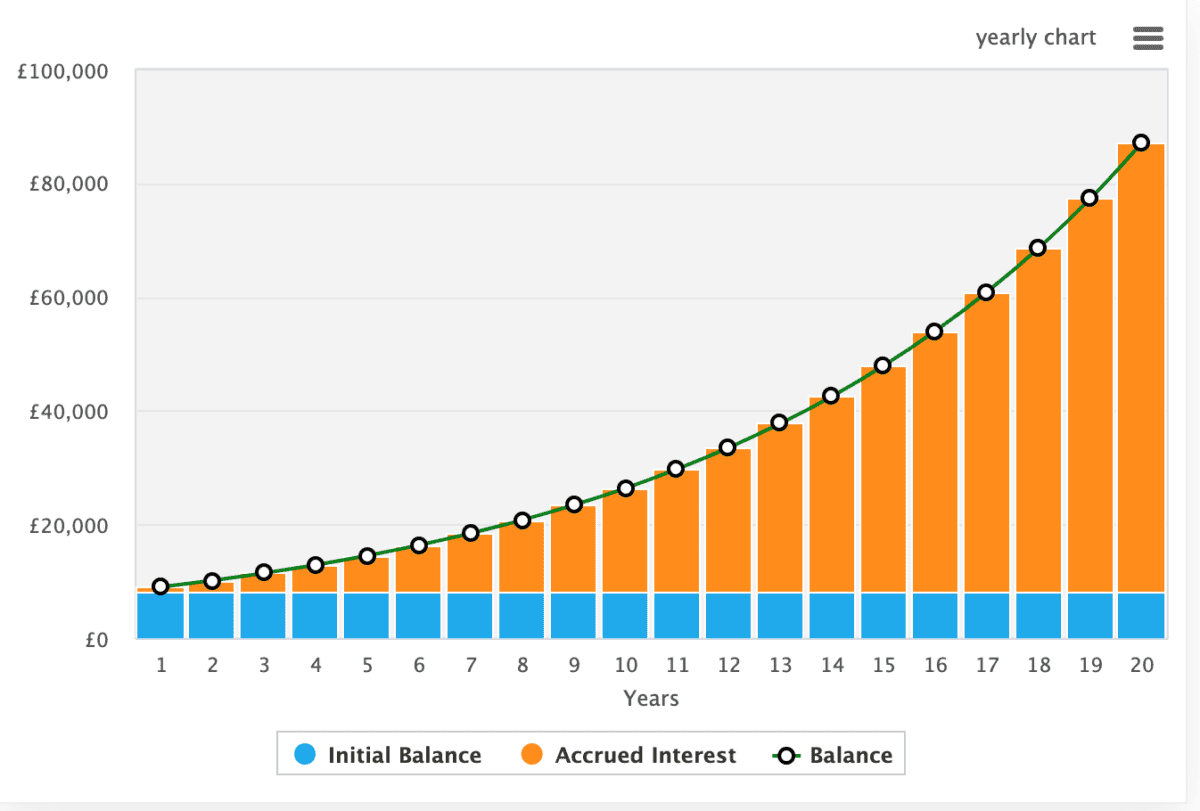

If I were to average a 12% annualised return over the next 20 years, I could turn £8,000 into £87,000. That would be enough to generate a second income worth around £6,960 a year, assuming an 8% dividend yield.

This is just an example. Some analysts may say 12% isn’t easily achievable, but I’d beg to differ.