What happened

Shares of Gores Holdings VI (GHVI) slumped 22.9% in March, according to data from S&P Global Market Intelligence. The special purpose acquisition company's valuation took a hit as investors moved out of growth-dependent technology stocks last month.

Gores Holdings VI (GHVI) went public early in February, and its stock has gained 65% from market close on the day of its debut thanks to excitement surrounding its pending merger with real estate software company Matterport. There wasn't any business-specific news related to Matterport or the merger driving GHVI's stock lower last month, but a pullback on tech stocks was enough to pressure the SPAC's share price.

Image source: Getty Images.

So what

Matterport operates a software-as-a-service (SaaS) visual data solution that allows real estate businesses and other enterprises to create immersive 3D remote tours. It's a service category that has huge growth potential, and it looks like the business is enjoying some impressive momentum. The February press release announcing its combination with the Gores Holding VI SPAC notes that the software company grew its subscriber base by more than 500% last year.

Now what

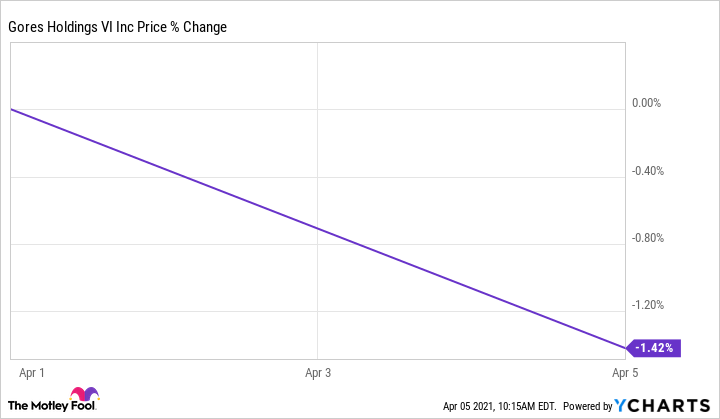

GHVI stock has dipped lower early in April's trading. The SPAC's share price is down roughly 1.4% in the month so far.

Gores Holdings VI's acquisition of Matterport is expected to close by the end of this quarter. Following completion of the merger, the company will operate under the Matterport name and trade on the Nasdaq Stock Market under the ticker symbol MTTR. At the time of merger announcement in February, the parties estimated that the combined company would have an adjusted enterprise value of roughly $2.3 billion and an equity value of $2.9 billion.