Categories Analysis, Leisure & Entertainment

Electronic Arts (EA): Two key factors that will drive growth for this video game company going forward

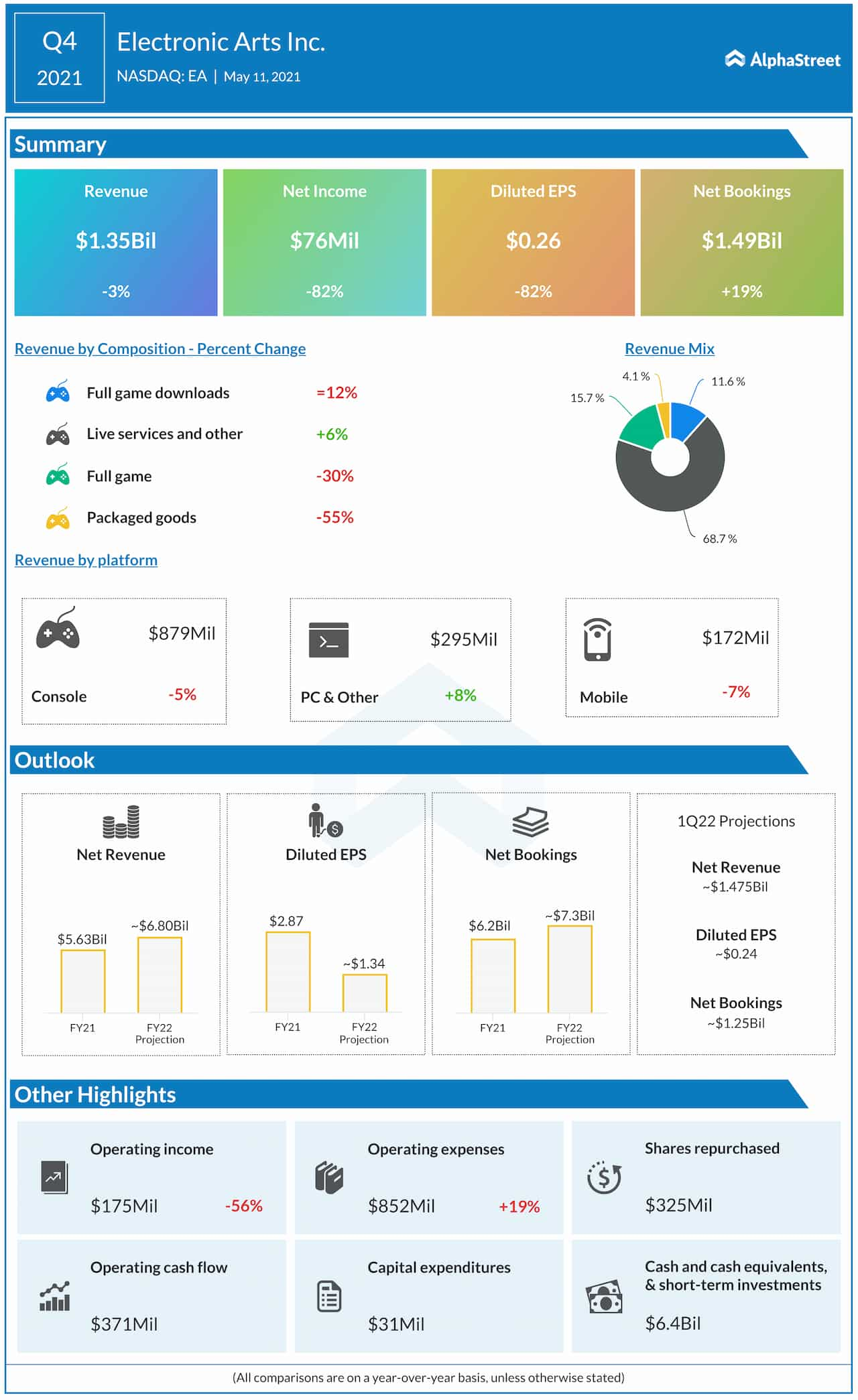

Overall net bookings for FY2022 are expected to grow around 18% YoY to $7.3 billion

Shares of Electronic Arts Inc. (NASDAQ: EA) have gained 9% in the past three months and over 7% in the past 12 months. Like its peers, Electronic Arts benefited from the rise in demand and engagement within the video game industry during the pandemic. The stock has a bullish sentiment around it as it is anticipated to see continued growth going forward. Here’s a look at two key growth drivers for the company:

Franchise strength

EA has a strong set of franchises, namely FIFA, Apex Legends, Madden NFL and Battlefield that have consistently delivered good growth and engagement for the company. During its most recent earnings call, the company said EA SPORTS FIFA has more than 100 million players worldwide while Apex Legends has over 100 million players life-to-date on console/PC.

FIFA Ultimate Team players increased 16% year-over-year while FUT matches were up 180%. Season 8 of Apex Legends had more than 12 million weekly average players. In FY2021, EA delivered 13 new games and saw over 42 million new players join its network. Net bookings for FY2021 rose 15% YoY to $6.19 billion.

The company recently unveiled Battlefield 2042 and Madden NFL 22, both of which are anticipated to get good responses. EA expects to see good growth from its key franchises in FY2022. All its new EA SPORTS games, including FIFA, Madden, NHL and EA SPORTS PGA are designed for the next-generation consoles which is a huge advantage.

Apex Legends and Battlefield are well-positioned to benefit from new game releases and the expansion into mobile gaming in FY2022. The company estimates net bookings for Apex Legends to grow nearly 20% YoY to $750 million in FY2022. Overall net bookings for FY2022 are expected to grow around 18% YoY to $7.3 billion.

Mobile gaming

Another key growth driver for EA is mobile gaming. The acquisition of Glu Mobile is expected to give the company a good push in this space. EA is working on acquiring new players and driving engagement for its mobile live services such as Star Wars: Galaxy of Heroes, The Sims and Real Racing. The company is also focusing on expansion opportunities into international markets.

EA plans to grow its sports mobile business by over 50% in FY2022. The company also plans to release mobile versions of Apex Legends and Battlefield in the near-term. On the back of the Glu acquisition, EA expects to more than double its mobile business to $2 billion in annual net bookings within the next three years.

According to TipRanks, the majority of analysts have given Electronic Arts a Buy rating and the stock has an average price target of $162.89, which reflects a 15% upside from the current level.

Looking for more insights on the earnings results? Click here to access the full transcripts of the latest earnings conference calls!

Most Popular

BIIB Earnings: Biogen Q1 2024 adj. earnings rise despite lower revenues

Biotechnology firm Biogen Inc. (NASDAQ: BIIB) Wednesday reported an increase in adjusted profit for the first quarter of 2024, despite a decline in revenues. Total revenue declined 7% year-over-year to

Hasbro (HAS) Q1 2024 Earnings: Key financials and quarterly highlights

Hasbro, Inc. (NASDAQ: HAS) reported first quarter 2024 earnings results today. Revenues decreased 24% year-over-year to $757.3 million. Net earnings attributable to Hasbro, Inc. were $58.2 million, or $0.42 per

BA Earnings: Highlights of Boeing’s Q1 2024 financial results

The Boeing Company (NYSE: BA) on Wednesday announced financial results for the first quarter of 2024, reporting a narrower net loss, on an adjusted basis. Revenues dropped 8%. Core loss,