Categories AlphaGraphs, Earnings, Technology

MU Earnings: Micron delivers stronger-than-expected Q4 results but stock dips

Micron Technology Inc. (NASDAQ: MU) Tuesday said its fourth-quarter revenues and profit increased in double-digits, aided by strong demand growth. The results also came in above the market’s projection, but the chipmaker’s stock declined in the extended trading session.

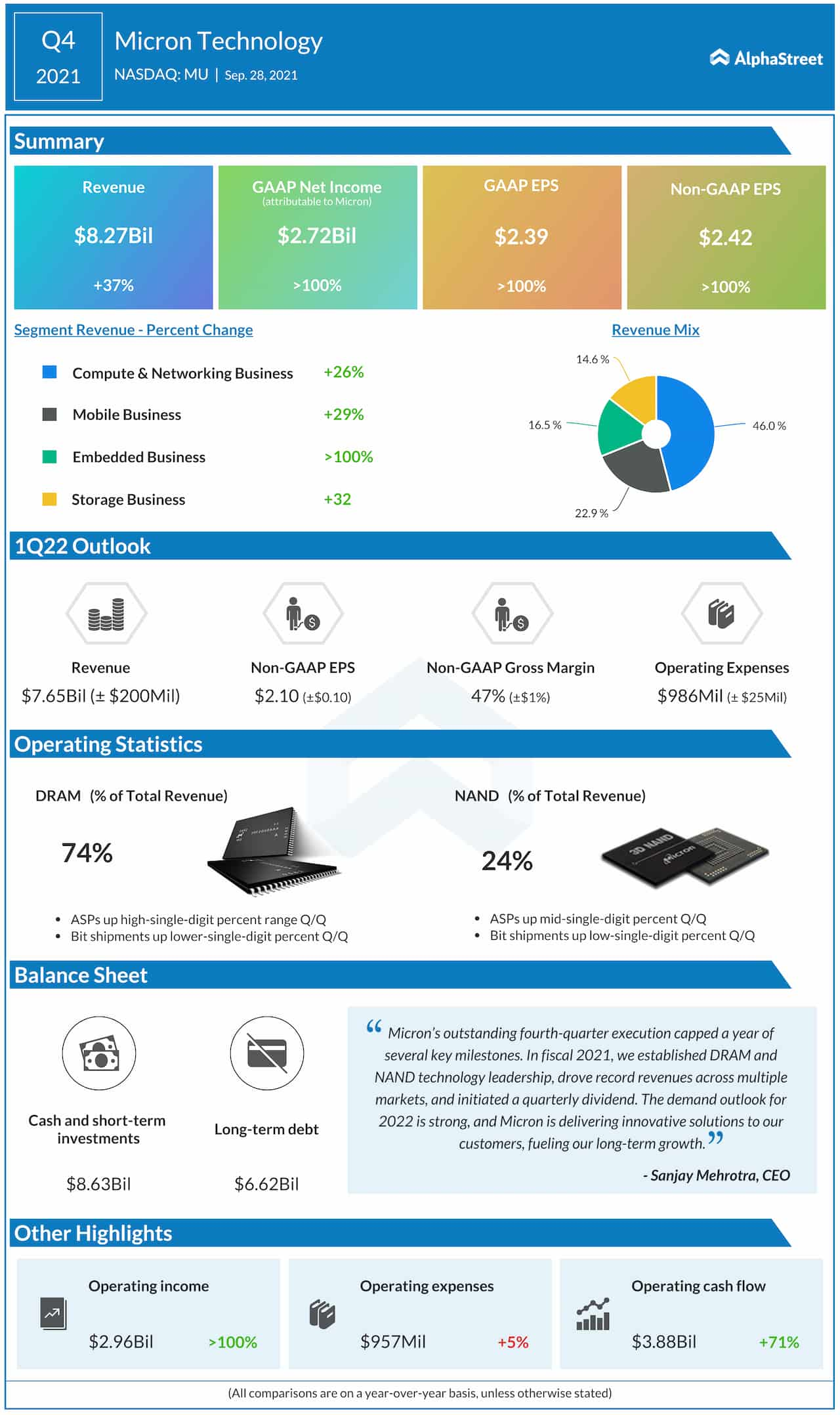

On an adjusted basis, fourth-quarter profit rose sharply to $2.42 per share from $1.08 per share a year ago. The impressive bottom-line performance reflects a 37% growth in revenues to $8.27 billion.

Unadjusted net income was $2.72 billion or $2.39 per share, compared to $988 million or $0.87 per share in the fourth quarter of 2020. Both revenues and earnings exceeded the consensus estimate.

“In fiscal 2021, we established DRAM and NAND technology leadership, drove record revenues across multiple markets, and initiated a quarterly dividend. The demand outlook for 2022 is strong, and Micron is delivering innovative solutions to our customers, fueling our long-term growth,” said Micron’s CEO Sanjay Mehrotra.

Read management/analysts’ comments on Micron’s Q4earnings

Micron’s stock closed Tuesday’s regular trading lower and continued to lose during the extended session after the announcement. In the past six months, the shares have declined 15%.

Prior Performance

_________________________________________________________________________________________________________________

Stocks you may like:

International Business Machines Corp. (IBM) Stock

_________________________________________________________________________________________________________________

Most Popular

PG Earnings: Procter & Gamble Q3 profit climbs, beats estimates

Consumer goods behemoth The Procter & Gamble Company (NYSE: PG) announced financial results for the third quarter of 2024, reporting a double-digit growth in net profit. Sales rose modestly. Core

AXP Earnings: All you need to know about American Express’ Q1 2024 earnings results

American Express Company (NYSE: AXP) reported its first quarter 2024 earnings results today. Consolidated total revenues, net of interest expense, increased 11% year-over-year to $15.8 billion, driven mainly by higher

Netflix (NFLX) Q1 2024 profit tops expectations; adds 9.3Mln subscribers

Streaming giant Netflix, Inc. (NASDAQ: NFLX) Thursday reported a sharp increase in net profit for the first quarter of 2024. Revenues were up 15% year-over-year. Both numbers exceeded Wall Street's